Fair and transparent taxation is essential to deter consumers or to attract them to less CO2 emitting transports

because climate matters

Fair and transparent taxation is essential to deter consumers or to attract them to less CO2 emitting transports

Europe got already a tool

1. The EU has already installed an Emissions Trading System

“The EU Emissions Trading System (EU ETS) is a cornerstone of the EU’s policy to combat climate change and its key tool for reducing greenhouse gas emissions cost-effectively. Continue reading “Europe can lead the path towards sustainable aviation”

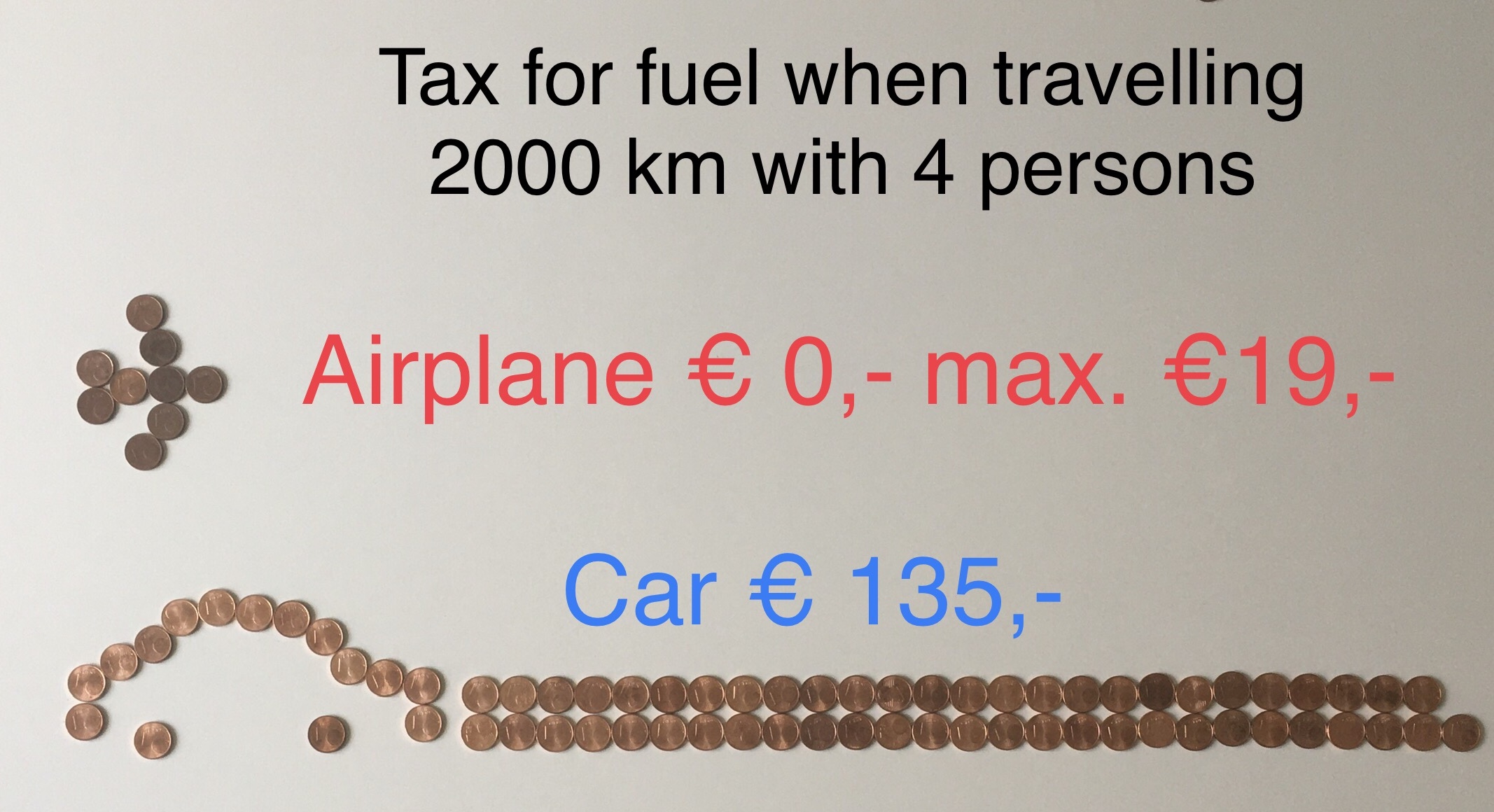

Assumptions:

Distance to destination 1.000 km. Airplane uses 3,65 L / 100 km per person. 1.000 km gives 36,5 L per person, or 146 L for 4 persons. No tax has to be payed for kerosene for international flights. Flights within the Emission Trading System (ETS) of the 28 EU member states plus Norwegen, Island and Lichtenstein pay €0,065 /L. This results in a tax of €9,49 for a single flight or €18,98 for a return flight. Lufthansa Fuel Consumption The Convention on International Civil Aviation (ICAO) (Chicago 1944, Article 24) exempts all tax on fuel of international flights. As do the EU taxation rules

A car uses about 7,5 L / 100 km or 75L for 1.000 km. The usual tax amount for fuel within the EU including VAT is around €0,90 / Liter. For 75 L this amounts to €67,5 and for the complete journey to €135,-. Gas taxes Europe 2019

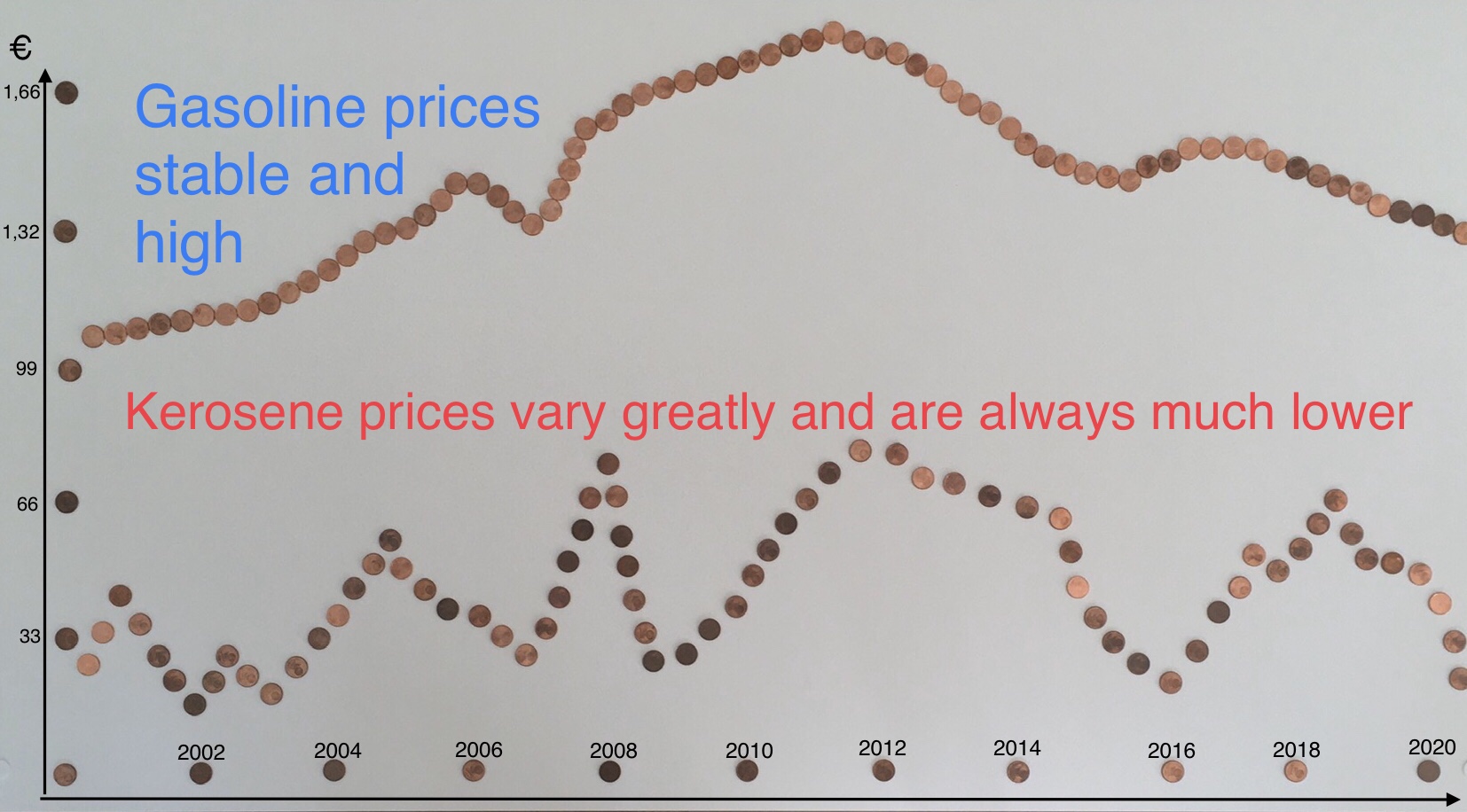

Car drivers pay constantly high prices for gasoline due to taxation. Prices for Kerosene are incredibly low and floating over a wide range.

The actual price for kerosene is € 0,22 /Liter and falling. In the past, it was as high as € 0,66 /Liter and as low as € 0,15 /Liter. Car drivers can only dream of …