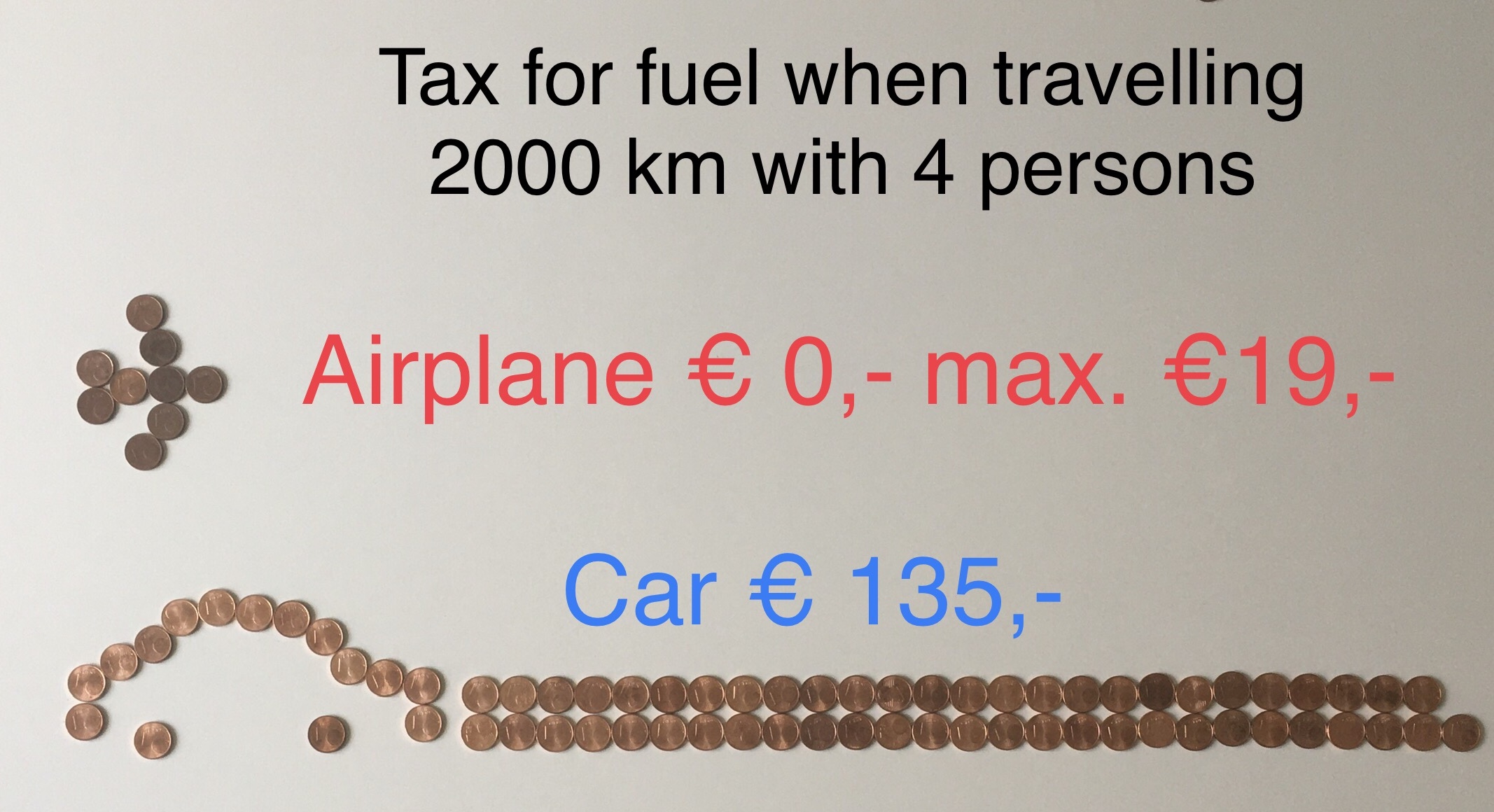

Fair and transparent taxation is essential to deter consumers or to attract them to less CO2 emitting transports

because climate matters

Fair and transparent taxation is essential to deter consumers or to attract them to less CO2 emitting transports

EU ETS trading must be extended to all flights landing or taking off in any EU ETS member state, but …

EU ETS CO2 emission counting must “stop the clock” at a certain distance CO2 emission rules for flights outside EU ETS airspace must stop at a certain (great-circle) distance, e.g. beyond 5,000 km. This “stop the clock” policy avoids unfair competition from flights with intermediate stops outside the EU ETS. Otherwise, fuel efficient direct flights get unfair competition from less fuel efficient flights with intermediate stops. Continue reading “When to stop the clock”

CO2 emission rules for flights outside EU ETS airspace must stop at a certain (great-circle) distance, e.g. beyond 5,000 km. This “stop the clock” policy avoids unfair competition from flights with intermediate stops outside the EU ETS. Otherwise, fuel efficient direct flights get unfair competition from less fuel efficient flights with intermediate stops. Continue reading “When to stop the clock”

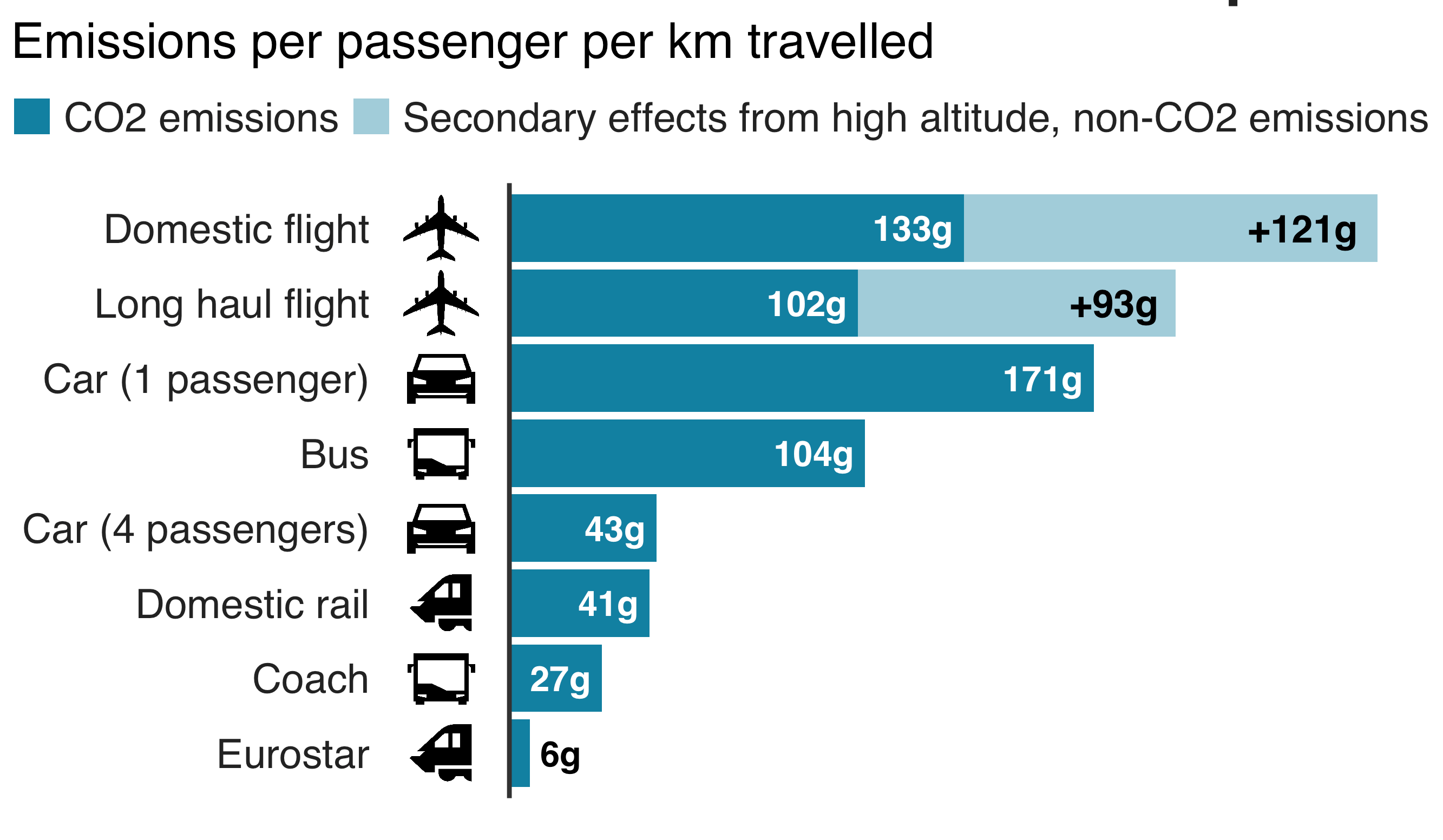

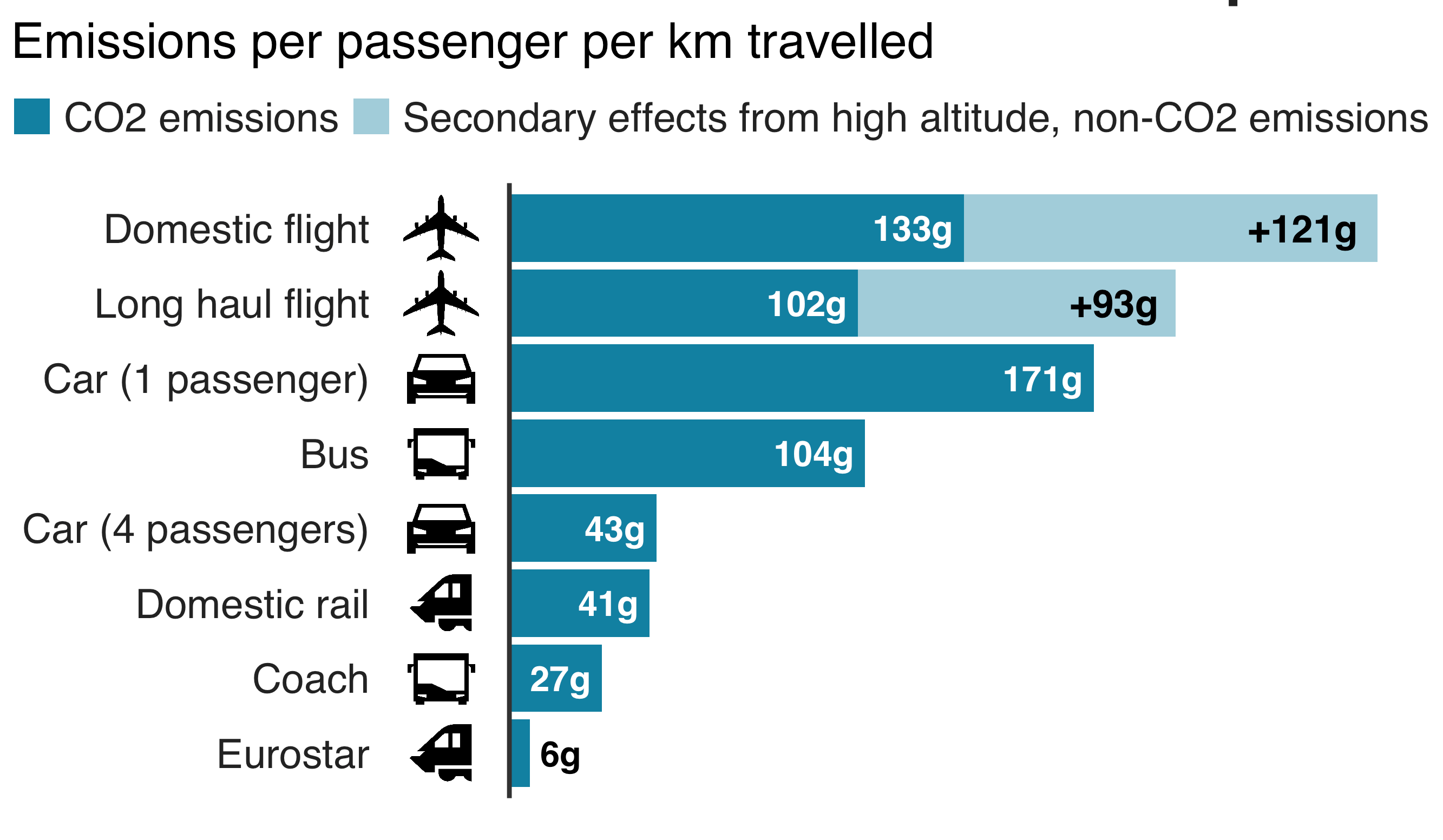

Establishing aviation’s CO2 emissions

1. Measurements

All airlines of EU ETS member states keep already a record of their fuel bills. They are charged for every metric ton of kerosene that is estimated to produce an equivalent of 3.15 tons of CO2.

2. Flight distance

Fuel bills of airlines from outside the EU ETS member states are not available for verification. However, these airlines can be charged accurately Continue reading “CO2 Emissions per route can be accurately established”

Europe got already a tool

1. The EU has already installed an Emissions Trading System

“The EU Emissions Trading System (EU ETS) is a cornerstone of the EU’s policy to combat climate change and its key tool for reducing greenhouse gas emissions cost-effectively. Continue reading “Europe can lead the path towards sustainable aviation”

Assumptions:

Distance to destination 1.000 km. Airplane uses 3,65 L / 100 km per person. 1.000 km gives 36,5 L per person, or 146 L for 4 persons. No tax has to be payed for kerosene for international flights. Flights within the Emission Trading System (ETS) of the 28 EU member states plus Norwegen, Island and Lichtenstein pay €0,065 /L. This results in a tax of €9,49 for a single flight or €18,98 for a return flight. Lufthansa Fuel Consumption The Convention on International Civil Aviation (ICAO) (Chicago 1944, Article 24) exempts all tax on fuel of international flights. As do the EU taxation rules

A car uses about 7,5 L / 100 km or 75L for 1.000 km. The usual tax amount for fuel within the EU including VAT is around €0,90 / Liter. For 75 L this amounts to €67,5 and for the complete journey to €135,-. Gas taxes Europe 2019