Pilots For Future was started by pilots who are concerned about aviation’s future impact on our planet. Our income’s dependency from aviation doesn’t make us immune to our doubts and fears about our negative effects on our world. Instead, our professional familiarity increases our consciousness. Continue reading “Who we are”

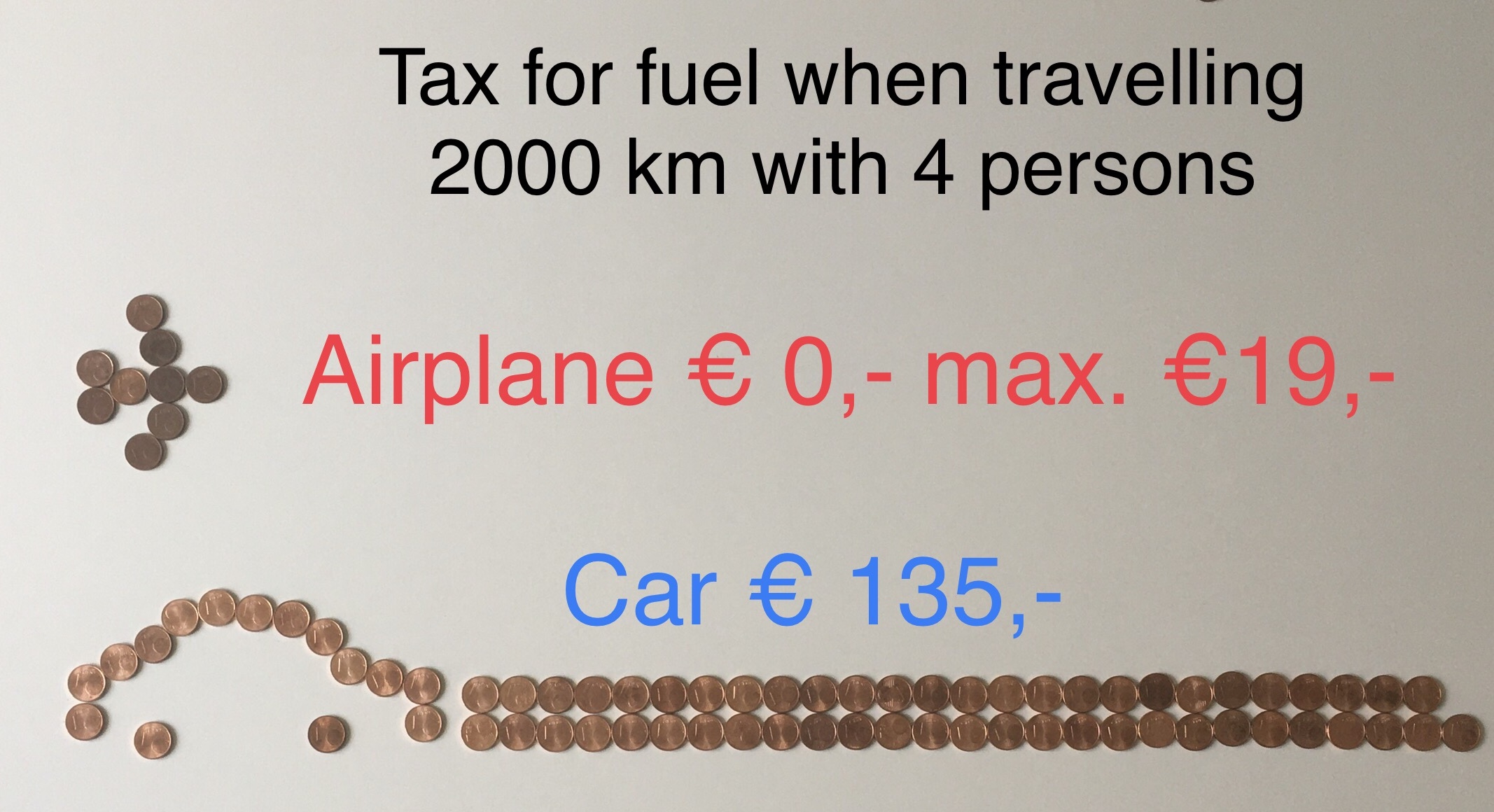

Who pays tax for fuel for an 1000 km long journey?

Assumptions:

Distance to destination 1.000 km. Airplane uses 3,65 L / 100 km per person. 1.000 km gives 36,5 L per person, or 146 L for 4 persons. No tax has to be payed for kerosene for international flights. Flights within the Emission Trading System (ETS) of the 28 EU member states plus Norwegen, Island and Lichtenstein pay €0,065 /L. This results in a tax of €9,49 for a single flight or €18,98 for a return flight. Lufthansa Fuel Consumption The Convention on International Civil Aviation (ICAO) (Chicago 1944, Article 24) exempts all tax on fuel of international flights. As do the EU taxation rules

A car uses about 7,5 L / 100 km or 75L for 1.000 km. The usual tax amount for fuel within the EU including VAT is around €0,90 / Liter. For 75 L this amounts to €67,5 and for the complete journey to €135,-. Gas taxes Europe 2019

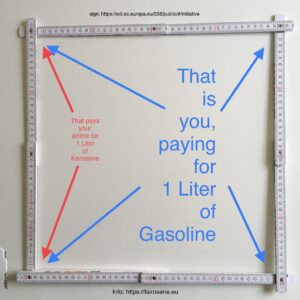

Prices for Kerosene are a joke

Car drivers pay constantly high prices for gasoline due to taxation. Prices for Kerosene are incredibly low and floating over a wide range.

The actual price for kerosene is € 0,22 /Liter and falling. In the past, it was as high as € 0,66 /Liter and as low as € 0,15 /Liter. Car drivers can only dream of …

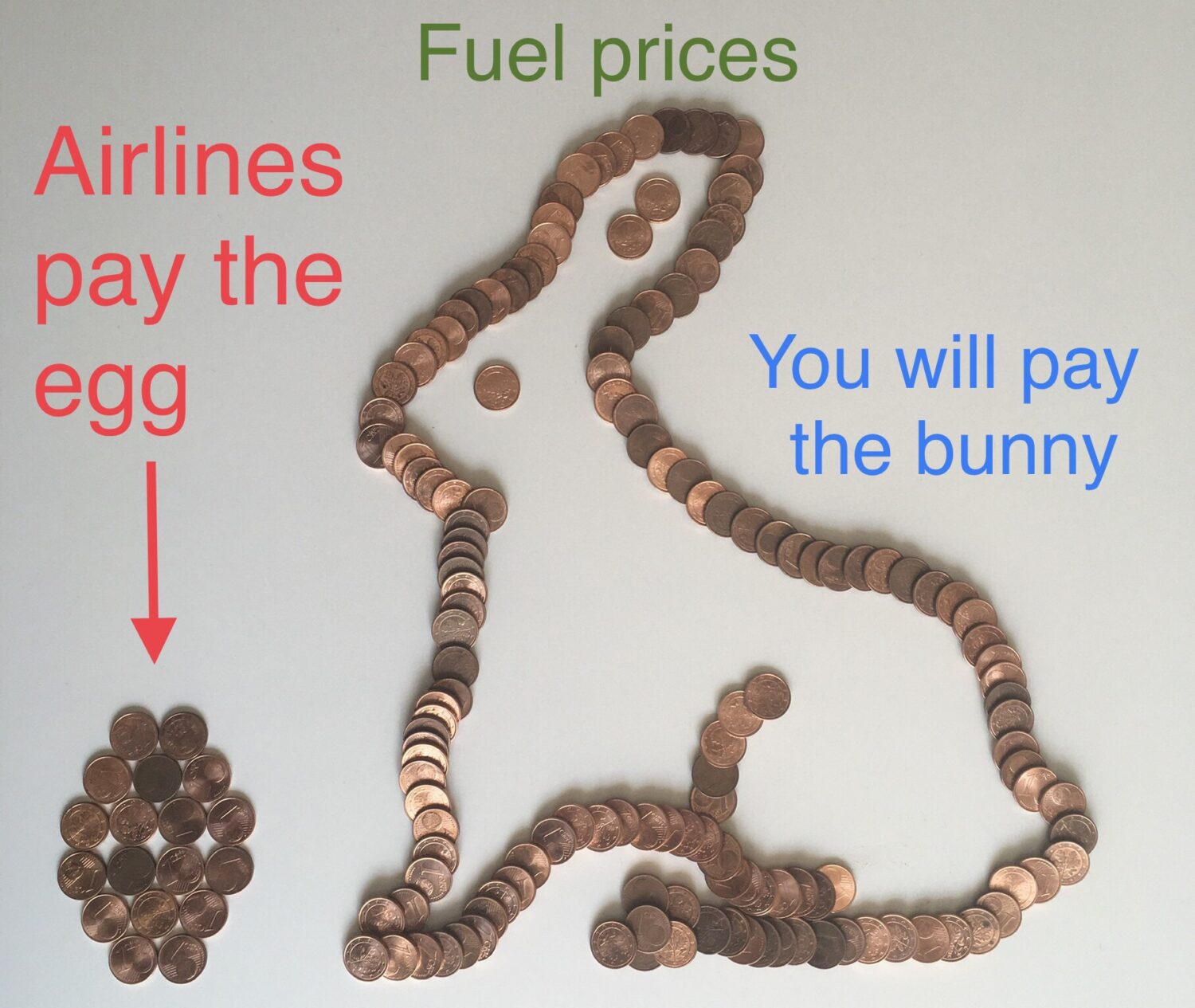

Easter Bunny

Unfair fuel tax exemption makes you pay for the bunny, whilst airlines only pay the price for an egg!

Aviation needs fair prices for kerosene

Current use of Kerosene is exempted from all taxes. This makes it volatile to market changes. Kerosene sells now for €-,35 per Liter. Prices will soon be even lower due to CORONA!

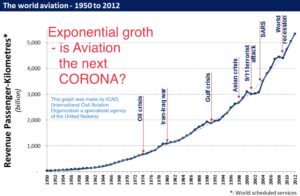

Is Aviation the next CORONA?

Exponential groth – Is Aviation the next CORONA?

it doubles every 10 to 15 years and is expected to be 7 times larger by 2050