Aviation’s continued exception of fuel-, emission- or value-added-tax is unfair

1. On international flights no tax is paid for the use of kerosene

This privilege was given to aviation in 1944 and is upheld until today. “The Convention on International Civil Aviation (ICAO) (Chicago 1944, Article 24) exempts air fuels …” https://en.m.wikipedia.org/wiki/Aviation_fuel

Aviation’s grandfather rights are outdated!

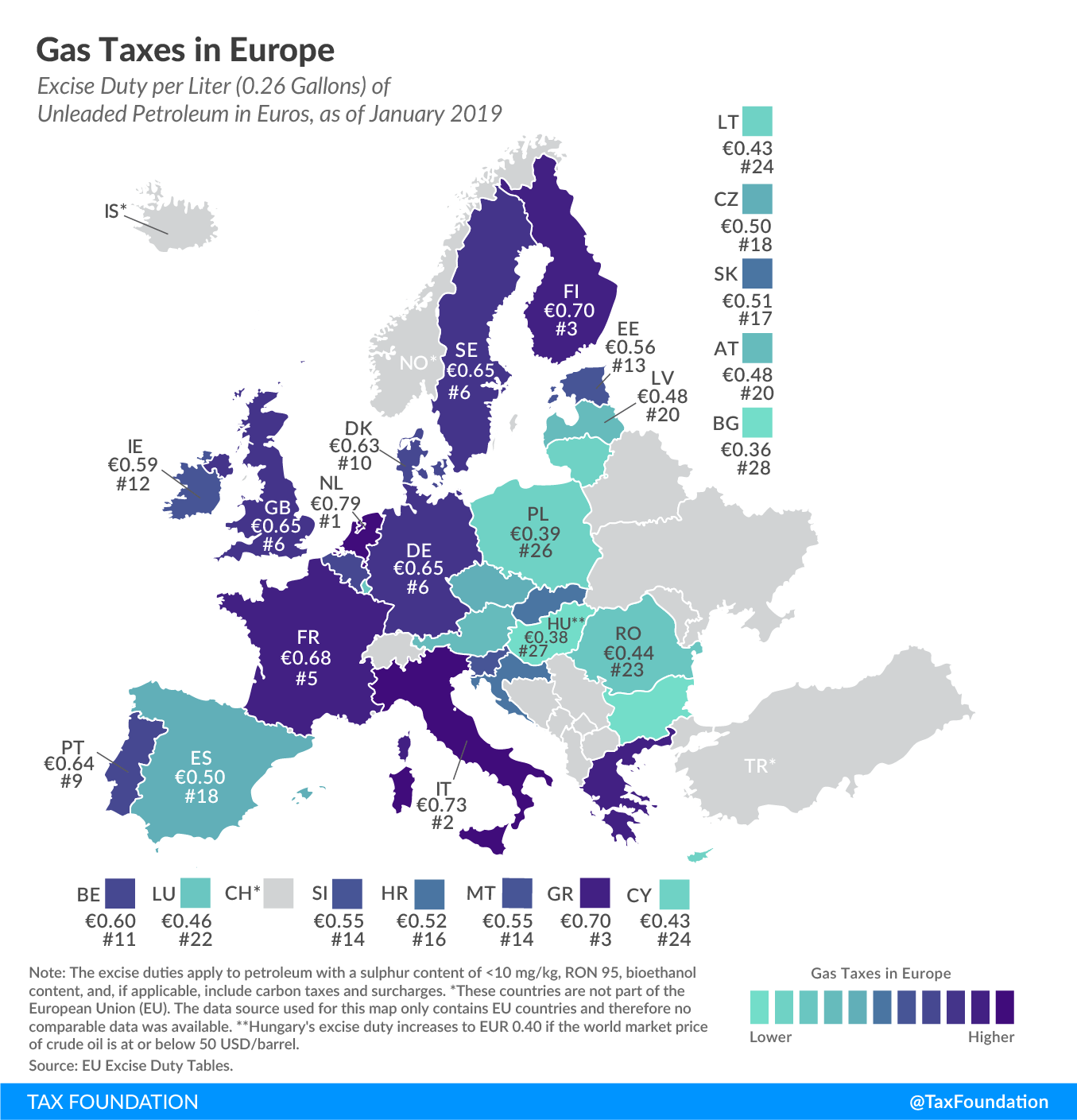

2. Car drivers, busses and trains pay tax for the use of gasoline

Please see below for the actual charges of energy tax within the EU https://taxfoundation.org/gas-taxes-europe-2019/

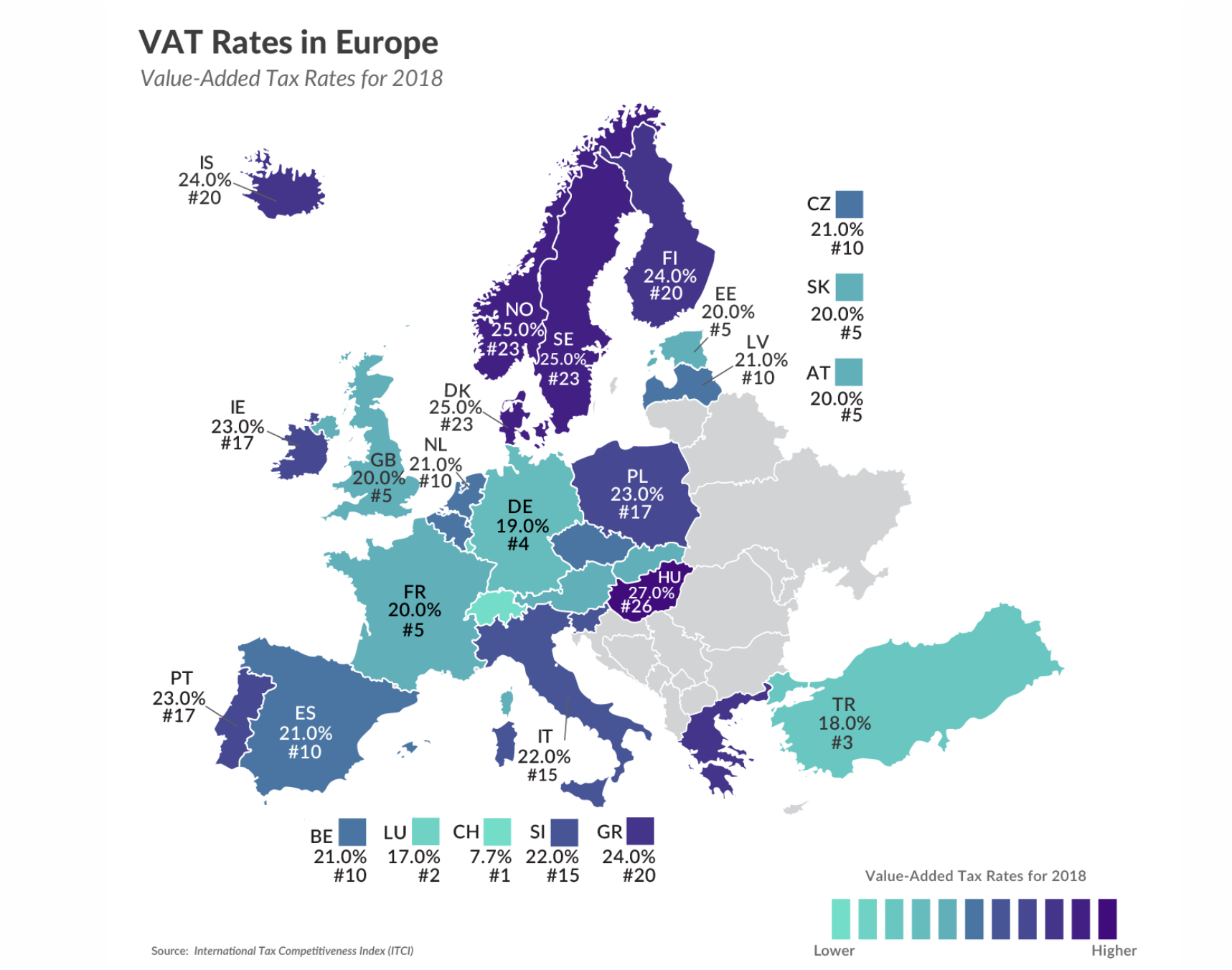

3. Car drivers, busses and trains do not only pay energy tax

Transport consumers pay not only energy tax but also Value Added Tax (VAT). When buying a Liter of fuel or a bus or train ticket, consumers have also to pay up to 25% of VAT.

4. International airline passengers do not pay Value Added Tax

Airline passengers do not pay Value Added Tax (VAT) on the price of their ticket. Eurowings, Why does VAT not appear on my invoice https://www.eurowings.com/en/information/news-help/faq/why-does-vat-not-appear-on-my-invoice.html

5. Airlines do not pay tax for the emission of CO2 either

Only for flights within the 28 EU member states plus Island, Norway and Lichtenstein € 0.065 per Liter of kerosene is charged by the EU CO2 Emission Trading System (EU ETS)

Current tax laws unfairly favours aviation.

Users of cars, busses and trains pay much higher taxes, when refuelling their car or when buying a ticket.

2 Replies to “What is causing it?”