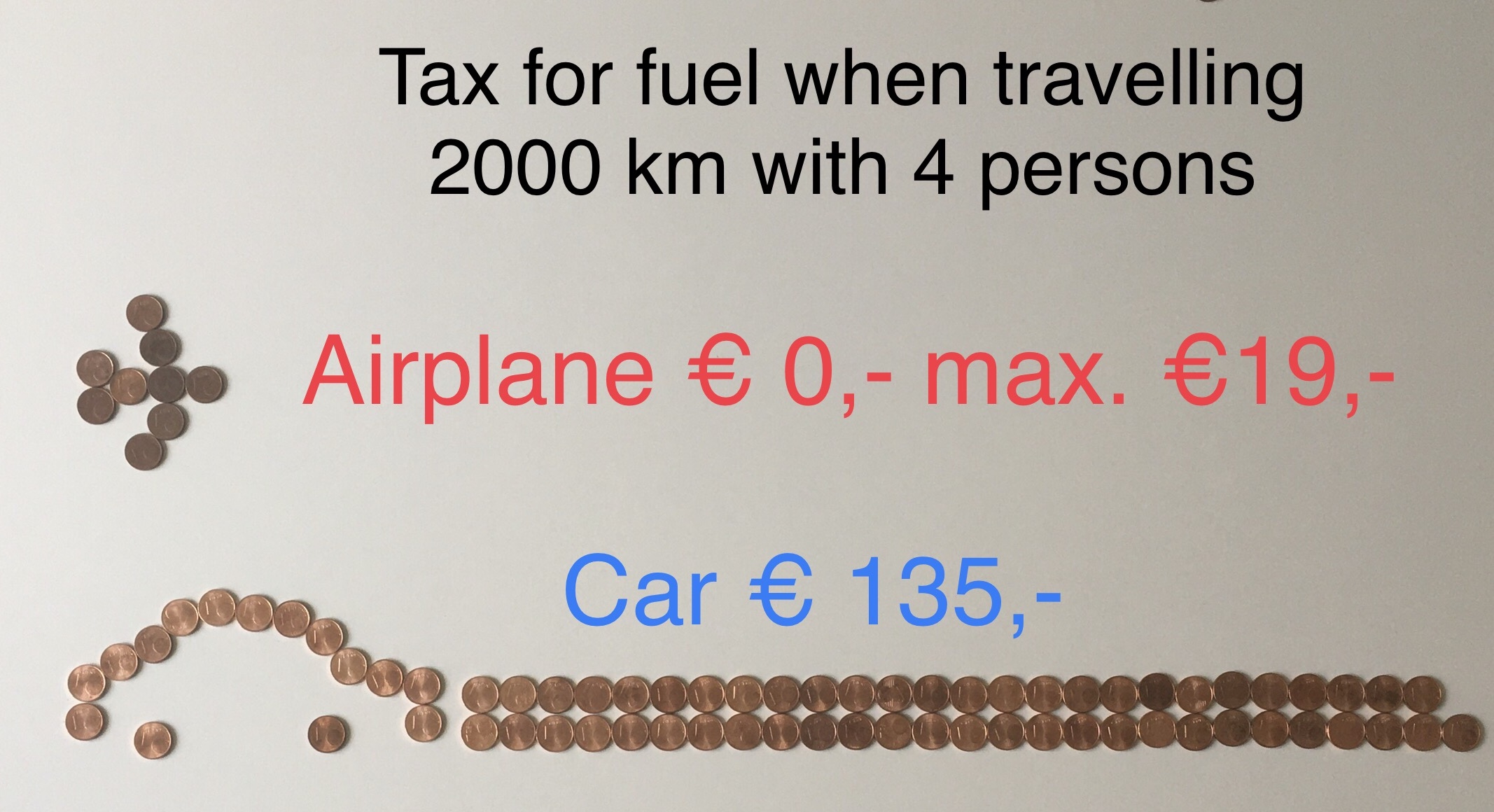

Assumptions:

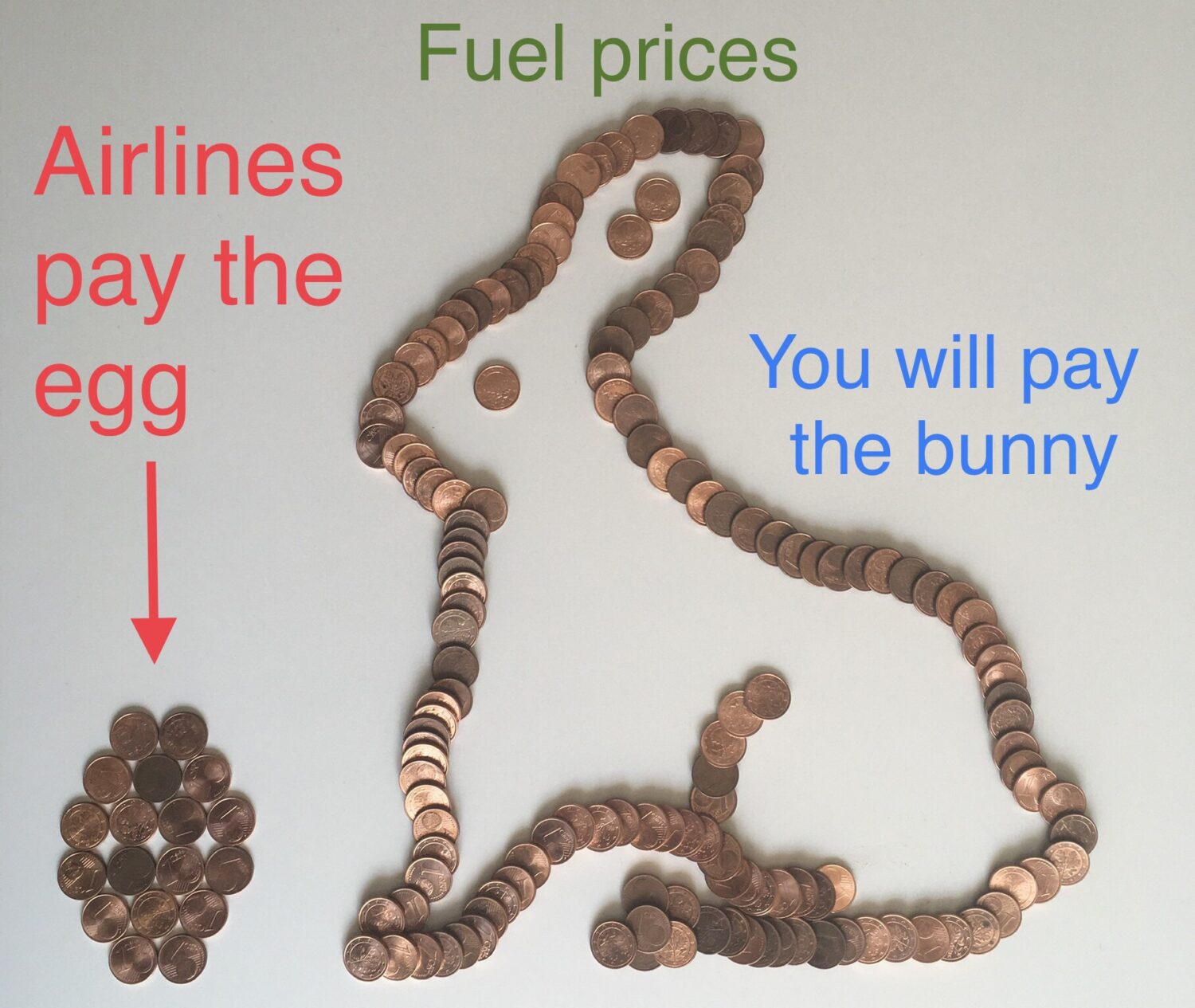

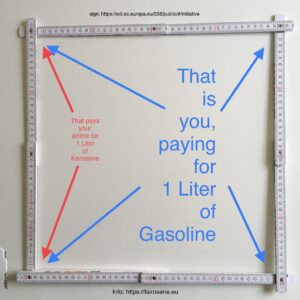

Distance to destination 1.000 km. Airplane uses 3,65 L / 100 km per person. 1.000 km gives 36,5 L per person, or 146 L for 4 persons. No tax has to be payed for kerosene for international flights. Flights within the Emission Trading System (ETS) of the 28 EU member states plus Norwegen, Island and Lichtenstein pay €0,065 /L. This results in a tax of €9,49 for a single flight or €18,98 for a return flight. Lufthansa Fuel Consumption The Convention on International Civil Aviation (ICAO) (Chicago 1944, Article 24) exempts all tax on fuel of international flights. As do the EU taxation rules

A car uses about 7,5 L / 100 km or 75L for 1.000 km. The usual tax amount for fuel within the EU including VAT is around €0,90 / Liter. For 75 L this amounts to €67,5 and for the complete journey to €135,-. Gas taxes Europe 2019